Motilal Oswal’s Business Opportunities Portfolio or BOP PMS follows the ‘Buy Right & Sit Tight’ policy, predominantly to invest in small & Mid Cap with focus on potential winners. Focus on sectors & Companies which promise a higher-than-average Growth by focusing on QGLP (Quality, Growth, Longevity, and Price).

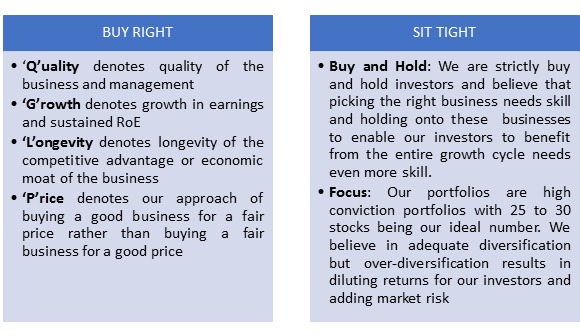

• Buy Right is represented by – (QLGP)

“Q” denotes the quality of the business and management

“G” denotes growth in earnings and sustained RoE

“L” denotes longevity of the competitive advantage or economic moat of the business

“P” denotes our approach of buying a good business for a fair price rather than buying a fair business for a good price

• Sit Tight

Buy and Hold: Strictly buy and hold and believe that picking the right business needs skill and holding onto these businesses to enable investors to benefit from the entire growth cycle needs even more skill.

Focus: High conviction portfolios with 25 to 30 stocks being our ideal number. We believe in adequate diversification but over-diversification results in diluting returns and add market risk.

Why ‘Buy Right, Sit Tight’ is significant?

• Real wealth is created by riding out bulk of the growth curve of quality companies and not by trading in and out in response to buy, sell and hold recommendations.

• This philosophy enables investor and manager alike to keep focus on the businesses they are holding rather than get distracted by movements in share prices

• An approach of buying high quality stocks and holding them for a long term wealth creation motive, results in drastic reduction of costs for the end investor.

• While BUY RIGHT is largely the role of the portfolio manager, SIT TIGHT calls for involvement from the portfolio manager as well as investor. This brings in greater accountability from the manager and at the same time calls for better involvement and understanding from investor resulting in better education for the latter.

• Long term multiplication of wealth is obtained only by holding on to the winners and deserting the losers.

Wealth Creators – Buy and Hold strategy

• BUY & HOLD strategy, leading low churn, lower costs and enhanced returns

• A business is prudently picked for investment after a thorough study of its underlying hidden long-term potential.

• “We don’t get paid for activity, just for being right. As to how long we’ll wait, we’ll wait indefinitely.” -Warren Buffett