Navigating FY26 with Data-Driven.

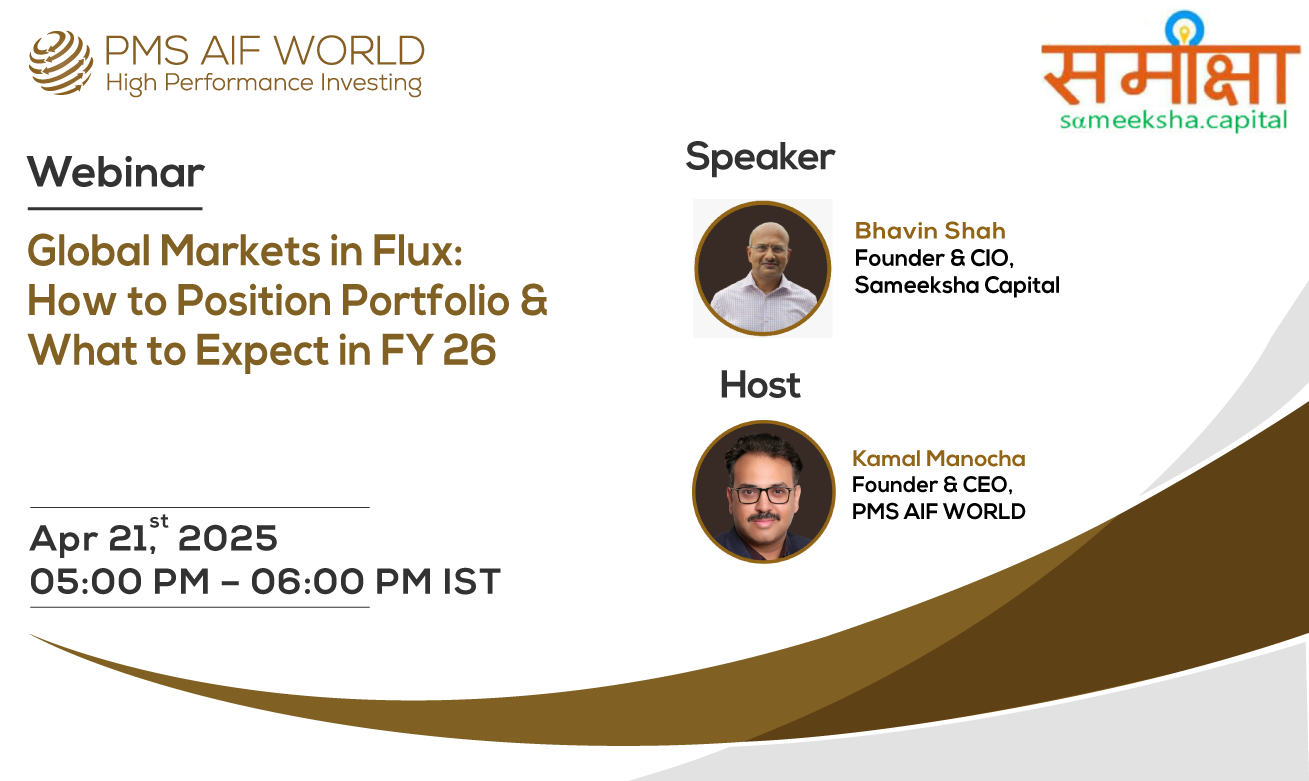

As global markets enter a delicate phase marked by geopolitical uncertainty, high interest rates, and uneven sectoral dynamics, PMS AIF WORLD hosted an insightful and timely webinar with Bhavin Shah, Founder & CIO of Sameeksha Capital. With over three decades of global investment experience across the US and India, and a deep specialization in technology and valuation analytics, Bhavin brought unparalleled clarity to the path forward for FY2026.

This wasn’t just a market commentary. It was a masterclass in disciplined investing, risk management, and global diversification — underpinned by data, process, and pragmatism.

Understanding the Macro: Optimism Amid Controlled Chaos

Bhavin laid the groundwork by interpreting recent market optimism through a macroeconomic lens. While Indian equities have rallied in recent sessions, he attributed the shift to a mix of supportive fiscal policy (including infrastructure spending and tax cuts), cooling inflation, and expectations of monetary easing by the RBI. Globally, he acknowledged the heightened uncertainty caused by US trade policy and political volatility but maintained that structurally, India remains well-positioned.

He emphasized that Indian markets reacted maturely to global developments, particularly the tariff-related rhetoric from the US, thanks to India’s relatively limited export exposure to the West and increasing domestic consumption tailwinds.

Sameeksha’s Philosophy: Valuation, Risk, and Patience

Bhavin’s investment philosophy is built around rules-based, valuation-centric investing. His proprietary “SUMA Ratio” — a synthesis of Return on Equity, Price-to-Book, and Interest Rates — gives a more dynamic lens through which to evaluate market valuations. According to this model, large caps are currently undervalued, while select pockets of mid and small caps remain frothy, requiring caution and stock-specific conviction.

He emphasized that Sameeksha does not chase narratives or themes. Every stock in their portfolio is selected through rigorous quantitative screens and fundamental research, aiming for asymmetric returns with lower drawdowns. This explains their strong information ratio, demonstrating superior risk-adjusted performance — a key metric that PMS AIF WORLD values deeply when recommending products to investors.

Case Study – Indigo Airlines: The Anatomy of a High-Conviction Bet

A highlight of the session was Bhavin’s deep dive into Indigo, a long-standing position in the Sameeksha PMS portfolio. From entering during times of industry pessimism to exiting at the onset of COVID and re-entering during value dislocations, the Indigo journey exemplified Sameeksha’s blend of macro foresight, sectoral insight, and bottom-up rigor.

By focusing on cost leadership, structural tailwinds in domestic aviation, and prudent capital allocation, Indigo became a classic example of how Bhavin’s process captures multi-year value — even in a sector as volatile as aviation.

Global Allocation: Strategic, Not Just Thematic

As investors increasingly consider geographical diversification, Bhavin addressed the role of his Global Equity PMS. With 60-70% exposure to the US and the remainder diversified across Europe and Asia, the strategy benefits from the market leadership of US-listed tech and healthcare giants. Bhavin explained that many US companies offer global earnings exposure, effectively giving investors access to multinational growth from a single listing.

He cautioned, however, that current US policy risks could cause underperformance in the short term. Yet, he believes this volatility could reset entry points, making this a compelling long-term allocation for investors seeking currency diversification and innovation-led growth.

PMS Construction: Why 40 Stocks Is Not Too Many

A participant raised a common question: why does Sameeksha PMS hold 40+ stocks, resembling a mutual fund? Bhavin offered a thoughtful response. Portfolio construction at Sameeksha is guided by liquidity rules, position sizing, and risk containment. Illiquid small caps are held with smaller weights; larger caps with higher liquidity are sized appropriately.

In essence, diversification is not a dilution of conviction, but a manifestation of risk discipline. Importantly, every investor in Sameeksha — including Bhavin himself — is aligned through identical portfolios and no external side bets.

Guidance for FY26: Realistic Returns, Long-Term Alpha

Bhavin did not make lofty promises but offered honest guidance. Assuming India’s nominal GDP grows 10–11%, equity markets could deliver similar returns. His portfolio aims for 11–24% IRR across companies, based on robust DCF-led valuation models. The past one-year performance validates this — Sameeksha outperformed the benchmark by nearly 2x, while keeping drawdowns materially lower during volatile periods.

For long-term investors, this combination of capital protection, valuation sensitivity, and forwardlooking research defines true wealth creation.

Why Investors Should Pay Attention

This webinar reinforced PMS AIF WORLD’s commitment to spotlighting strategies that are data-backed, conviction-led, and designed to deliver risk-adjusted alpha — not just returns.

For investors seeking clarity in complexity, Bhavin Shah’s insights provide a powerful filter. And for those comparing offerings like Green Lantern or thematic mutual funds, this session demonstrates why our due diligence, selection rigor, and manager access at PMS AIF WORLD set us apart.

Disclaimer: Securities investments are subject to market risks and there is no assurance or guarantee that the objective of the investments will be achieved. The statements contained herein may include statements of future expectations and other forward-looking statements that are based on our current views and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements

Do Not Simply Invest, Make Informed Decisions

WISH TO MAKE INFORMED INVESTMENTS FOR LONG TERM WEALTH CREATION