In our previous yearly outlooks, we highlighted a change in earnings trend which was leading to a shift in fortunes for the manufacturing and manufacturing allied businesses, and that hypothesis is largely playing out. We believe for CY 2024 one should “Stay the Course”. Policy continuity post elections can set the tone for economy and markets for the next leap, since the foundation has been laid over the last decade to make India a manufacturing hub. This coupled with government’s sustained thrust in capex (Railways, Defence, Water, Telecom, Renewable Power, Transmission & Distribution etc.) can act as a twin force to further support investee companies to leapfrog over the next decade.

Over the past decade, a solid foundation has been laid to position India as a manufacturing hub, setting the stage for sustained growth. The government’s unwavering commitment to capital expenditure across various sectors, including Railways, Defence, Water, Telecom, Renewable Power, Transmission & Distribution, acts as a formidable twin force. This concerted effort not only bolsters existing investee companies but also positions them to leapfrog ahead over the coming decade.

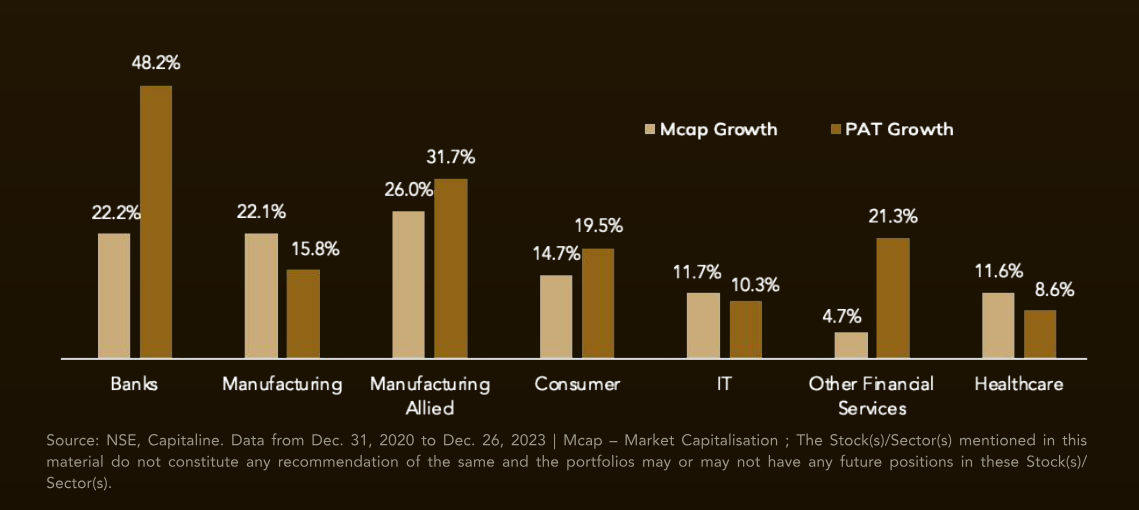

CY 2023 was defined by prudent stock-picking to identify good businesses across market capitalization. On that front, we found more B2B businesses in the manufacturing and manufacturing allied businesses, as they lead the turnaround in earnings growth as well as RoE improvement. The turnaround was primarily driven by the increasing necessity globally to create alternate supply chains and to also ensure that there is a supply led response to the long period of underinvestment in some of these sectors. The businesses in this space have also done well to use the improved industry scenario to deleverage and improve their balance sheet health.

Exhibit: Mcap and PAT Growth of Manufacturing and Manufacturing Allied Businesses

For more than a decade, India’s Return on Equity (ROE) lagged behind its long-term average. The period between 2003 and 2007 witnessed certain capital-intensive and cyclical sectors elevating their ROEs and Price to Book (P/B) ratios (exceeding 5x at the peak of the profit cycle). Looking ahead to 2024, a similar prospect of ROE improvement is plausible, given India’s substantial enhancement in macroeconomic indicators, the robustness of the banking sector, and heightened readiness of India Inc. to invest. The anticipated investment cycle in India hinges on two pivotal factors – government/public investment and private investment.

The Trend to Continue in CY 2024

We believe the trend which has changed (from B2C to B2B) will likely to continue in the year 2024 as well. This is well supported by India’s new focus towards manufacturing and services exports to potentially benefit from the creation of alternate supply chains. The improved corporate health with high free cash flow generation and repaired balance sheets for banks set the stage for recovery in the private capex cycle. Coupled with this, the heavy lifting on Infra capex from the Government and the end user demand led recovery in the real estate cycle after a decade. This is likely to propel demand in the economy. An improving global economy and room for rate reductions in a few years could provide support to the cycle after 2-3 years.

We believe India has already entered into a new upcycle, which we expect will last for a few years. As observant of previous cycles, there will always be disbelief amongst market participants through the period, as every new market high or earnings may appear as a peak. Any corrections will be characterised as the end of the cycle. The reality is that all the signs suggest that we are in an upcycle phase and similar disbelief on the cycle cannot be ruled out.

During the previous upcycle of 2002-09, the average annual EPS growth of Nifty 50 index was ~31%. We are seeing signs of a rebound already, with FY23 seeing 18% EPS growth in Nifty 50 index and 40% in mid-cap oriented indices. Consensus earnings estimates are for an average of 16% and 29% growth respectively, till FY25. With several secular and cyclical factors in play, we believe mid to high-teen growth looks value creation in the equity markets – albeit it is difficult to say, if this tide will lift all the boats, so bottom-up stock picking remains key.

The improving demand environment for capital-intensive and cyclical stocks expected to do well for the portfolios managed by us. The key for us has been our focus towards companies with prudent capital allocation, earnings growth and improving RoEs. In the current scenario, we are finding that companies in B2B space have better earnings growth potential and are available at reasonable valuations. We believe these names are not as yet fully appreciated by market and in that sense, offer relatively better risk/reward vs the broader markets. These reasons align with our investment style for investing in B2B companies even if the markets are at new highs.

Key Sub Themes

From our quest to identify businesses, on bottom up basis, the ones that are seeing improved potential for earnings

growth and ROE improvement have the below common sub-themes. These are in addition to themes already discussed on manufacturing, manufacturing allied and corporate banks – discussed in 2023 outlook;

• Rising Energy Intensity

• Increasing Urbanization

• Government Capex On Strategic Sectors

• Financialisation On a Sturdy Digital Backbone

• Experiential Consumption

To read the themes in detail, click here Annual Outlook 2024

The Stock(s)/Sector(s) mentioned in this material do not constitute any recommendation of the same and the portfolios may or may not have any future positions in these Stock(s)/Sector(s).