How PMS AIF WORLD is helping Investors Create Wealth? - Ask Kamal Manocha

September 4, 2020 @ 5:30 PM – 6:30 PM

How PMS AIF WORLD is helping Investors Create Wealth? - Ask Kamal Manocha

September 4, 2020 @ 5:30 PM – 6:30 PM

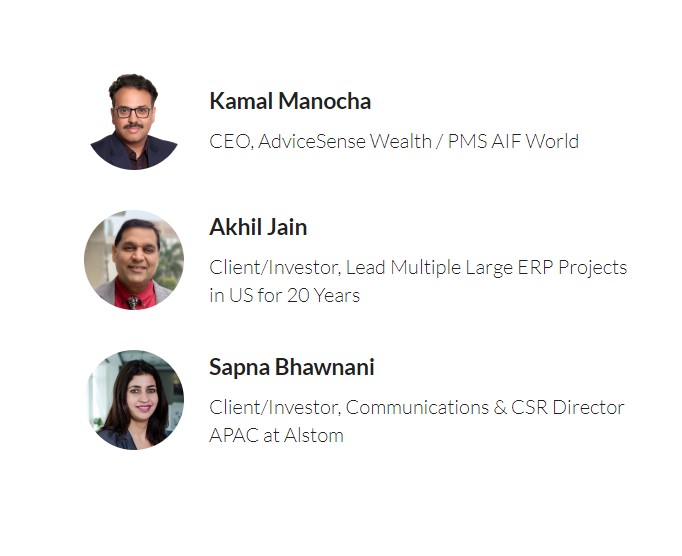

Kamal Manocha – CEO, AdviceSense Wealth / PMS AIF WORLD

Akhil Jain – Client/Investor, Lead Multiple Large ERP Projects in US for 20 Years

Sapna Bhawnani – Client/Investor, Communications & CSR Director APAC at Alstom

In general, when investors think of Debt, they first think of low return and then risk, and this where they make mistakes. Ultimately, as investor’s focus is on return while investing in debt, he/she take exposure in credit funds, hybrid debt funds, structured products, NCDs and eventually end up adding a lot of unknown risk to this asset class which is supposed to actually provide security and safety of capital. As per our philosophy, in structuring the debt portfolio, the objective should to reduce risk and not increase returns. So, we do not suggest credit or interest rates or concentration risk and follow a highly diversified approach through well researched high-quality portfolios of low duration debt mutual funds. Such structuring provides confidence to investors to better focus on equity portfolio from where the objective is high returns.

In general, when investors think of equity, they first think of high risk and then return and this is where they make mistakes. Ultimately, as investor focus is on reducing risk, investors take exposure in every theme(International, Gold, Balanced, Hybrid), every type of fund/portfolio, and eventually ends up owning over–diversified portfolio that grossly underperforms even in long term period of 10 years. As per our investing philosophy, in structuring the equity portfolio, the time horizon is clearly 5 to 10 years, so the objective should be to enhance returns and not reduce risk. So, we follow a less diversified approach through Best PMS & AIF products, along with the Best Focused category of Mutual Funds.

We follow a very simple, open-ended approach to building clean debt and quality equity portfolio and then work with clients to ensure they hold such good investments with confidence and high conviction PMS AIF WORLD’s AdviceSense Philosophy Explained in an Equation:

Clean Debt + Quality Equity + High Conviction = Compounding

Clean Debt Portfolio: A Clean Debt means a well-diversified portfolio of high rated short duration securities. Mutual Fund is a very good structure to achieve this, as it is well diversified, well regulated, highly liquid, and offers tax-efficient returns. Just remember, select keeping in mind Safety as a prime objective and not return as the prime objective.

Quality Equity Portfolio: A Quality Equity Portfolio is the one that is not too much diversified, & still offers the best risk-adjusted returns. With us, this is identified through unbiased selection based on our proprietary analytics. It’s easy to socialize and sell products, which is what most wealth managers do. We’re reshaping the wealth management industry by sticking to basics, in-depth analytics. We maintain insight + integrity and aim at the long term prosperity of clients.t decisions.

High Conviction: It is easy to aspire for a long term horizon when making an investment, but practically very difficult to maintain. With us, this is achieved through our educative super simple & articulate proprietary content. Holding on to the portfolio requires high conviction in the portfolio at all points of time, else, one tends to exit early owing to the traps of emotions or impatience. We ensure our clients make informed investment decisions.

WISH TO MAKE INFORMED INVESTMENTS FOR LONG TERM WEALTH CREATION