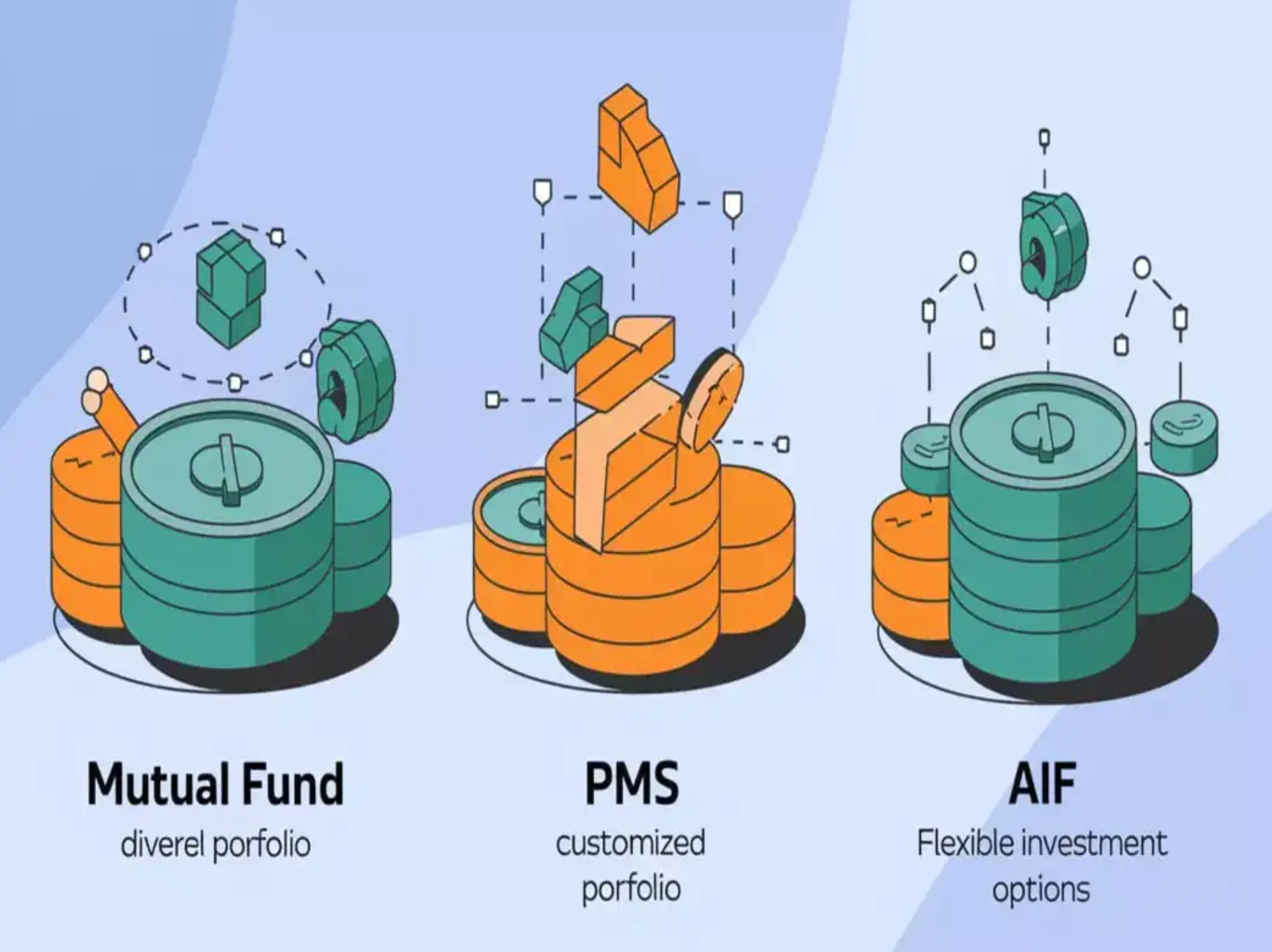

When investors in India start comparing investment options, the discussion usually begins with mutual funds. At some point, though, many start hearing about PMS and AIFs, and that’s when confusion sets in.

All three talk about returns, professional management, and long-term wealth, yet they behave very differently in practice.

So the real question is not which one is better in absolute terms. The real question is where PMS fits when placed alongside mutual funds and AIFs, and how an investor should think about this PMS comparison in India.

Let’s look at this more closely and put PMS in the right context.

Mutual Funds – starting point for most investors

Mutual funds are generally easy for investors to get into. They’re also fairly tightly regulated and are designed for scale, which is why they tend to attract a very large investor base.

In many cases, a single fund ends up managing money for thousands, and sometimes even millions, of people.

Once you operate at that kind of scale, portfolio construction changes.

Funds usually spread their bets across many stocks and stay reasonably close to an index or a stated benchmark, simply because that’s the most practical way to manage such large pools of capital.

However, this same structure also creates limitations.

- Portfolios are built at the fund level, not customized for each investor.

- Fund managers have to work within clearly defined mandates and liquidity limits, which narrows the range of decisions they can actually take.

- When the fund is large, flexibility in choosing or exiting stocks naturally reduces.

As portfolios grow, many investors begin to feel that mutual funds no longer provide enough customization or active decision-making. This is usually where the PMS vs Mutual Fund conversation starts to feel relevant.

PMS – The middle ground of simplicity & control

Portfolio Management Services sit between mutual funds and AIFs in terms of structure and flexibility.

Unlike mutual funds, PMS portfolios are managed at an individual client level.

Investors can see exactly which stocks they own, how allocations change, and how decisions are executed. This transparency is a key reason PMS attracts high-net-worth investors.

From a strategy point of view, PMS managers don’t have to stick close to an index.

Positions can be more concentrated, cash can be held when opportunities don’t look compelling, and capital can be deployed with higher conviction in a smaller set of ideas.

It’s this flexibility that often makes PMS attractive to investors who want something more active than traditional funds, but still want to stay away from strategies that feel too complex or hard to follow.

But again, PMS is not designed to do everything. This is where AIFs play a different role.

AIFs – Strategy-led and outcome-focused

AIFs are used when a strategy doesn’t sit comfortably inside a traditional long-only equity setup.

In practice, that can mean very different things depending on the category. Some managers use derivatives, some run long-short books, and others apply leverage or look at private market opportunities.

The common thread, though, is not the tools themselves. It’s the attempt to build return streams that don’t rely entirely on the market moving in one direction.

So, AIFs are usually considered when investors want:

- Diversification beyond equity-only exposure

- Access to structured or alternative strategies

- Returns driven by strategy design rather than market cycles

This is why discussions around the Best AIF in India tend to be less about absolute returns and more about how the strategy behaves across different market environments.

Compared to PMS, AIFs can be more complex and less transparent at a portfolio level. Liquidity terms may also be more restrictive. However, they serve a very specific purpose within a well-constructed portfolio.

Where does PMS stand in this comparison?

When investors look at these options together, PMS often comes across as the middle ground.

Mutual funds are built for scale and ease, AIFs allow for deeper and more specialised strategies, and PMS offers a focused approach with greater control, without moving too far away from transparency.

This is why, in a lot of cases, PMS forms the active equity core, with mutual funds and AIFs supporting the portfolio in different ways.

Putting PMS and AIF choices in perspective

As portfolios expand, investors often evaluate PMS and AIFs side by side. Doing this manually can be time-consuming because each product presents information differently.

Structured platforms like PMS AIF WORLD help bridge this gap by bringing PMS and AIF strategies onto a common comparison framework.

Instead of reviewing documents and performance data separately, investors can assess strategy structure, risk metrics, and performance behaviour in one place.

This becomes especially useful when deciding how to allocate capital across PMS, AIFs, and existing mutual fund holdings.

Wrapping Up

PMS doesn’t take the place of mutual funds, and it isn’t really competing with AIFs either. Its role is more specific, giving investors a way to actively manage equity with greater control.

Also, when you compare PMS strategies on a platform like PMS AIF WORLD, the contrasts become much clearer, making it easier to choose combinations that fit together effectively.