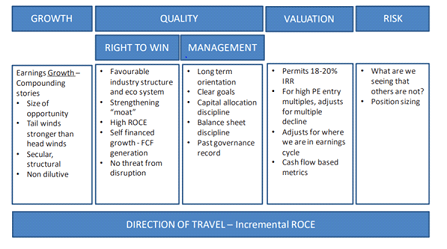

The objective is to invest in compounding stories (companies with tail winds of growth that are focused on disciplined growth around a core business definition, and where success is reflected in an expanding moat and increasing market share and ROE).

| Alpha (1Y) | Beta (1Y) | Standard Deviation (1Y) | % of +ve Months (SI) |

|---|---|---|---|

| -3.67% | 0.80 | 12.16% | 66.38% |

Performance Table #

| Trailing Returns (%) | 1m return | 3m return | 6m return | 1y return | 2y return | 3y return | 5y return | 10y return | Since inception return |

|---|---|---|---|---|---|---|---|---|---|

| Solidarity Advisors Pvt Ltd Prudence | -1.51% | -2.94% | -3.06% | 5.36% | 10.26% | 12.75% | 12.77% | - | 15.99% |

| S&P BSE 500 TRI | -3.34% | -2.64% | 0.98% | 7.74% | 8.72% | 16.40% | 16.44% | 15.04% |

QRC Report Card *

| Strategy | Category | Fund Manager | Date of Inception | Age Of PMS | Corpus (in Cr, approx) | Benchmark | Returns SI (CAGR) | Stocks In Portfolio | Sectors In Portfolio |

|---|---|---|---|---|---|---|---|---|---|

| Solidarity Advisors Pvt Ltd Prudence | Multi Cap & Flexi Cap | Mr Manish Gupta | 11 May 2016 | 9Y 9M | 1583.95 | S&P BSE 500 TRI | 15.99% | - | NA |

| Portfolio Quality (Q) | Portfolio Risk (R) | Portfolio Consistency (C) | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Index | Category Alpha (1Y) | Relative Alpha (1Y) |

% of +ve Months

(Fund Data) |

Alpha (1Y) | Beta (1Y) |

Standard Deviation (1Y)

(Fund Data) |

Sharpe Ratio (1Y)

(Fund Data) |

Alpha (SI) | Information Ratio (SI) | Consistency Ratio % |

| Nifty 50 | -10.88% | 3.39% | 66.38% | -7.49% | 0.84 | 12.16% | -0.05 | 3.17% | 0.28 | 50.00 % |

| Nifty 500 | -7.24% | 3.57% | -3.67% | 0.80 | 2.09% | 0.22 | 52.59 % | |||

| Nifty Midcap 100 | -6.45% | 3.73% | -2.72% | 0.62 | -1.04% | -0.10 | 49.14 % | |||

| Nifty Smallcap 100 | 4.66% | 3.98% | 8.64% | 0.50 | 2.48% | 0.19 | 49.14 % | |||

VIEW DETAILED QUALITY, RISK, CONSISTENCY ANALYSIS

Portfolio Holdings

| Holding | % |

|---|

Sector Allocation

| Holding | % |

|---|

Market Cap Allocation

| Allocations | % |

|---|---|

| Large Cap | |

| Mid Cap | |

| Small Cap | |

| Cash |

Do Not Simply Invest, Make Informed Decisions

WISH TO MAKE INFORMED INVESTMENTS FOR LONG TERM WEALTH CREATION

Disclaimer

#Returns as of 31st Jan 2026. Returns up to 1 Year are absolute, above 1 Year are CAGR.

*QRC Report Card data is updated quarterly. Current data is as of Dec 25.