PMS AIF WORLD brings to you

CRYSTAL GAZING 7.0

ALTERNATES SUMMIT & AWARDS 2026

Clarity in Uncertain Times

27th & 28th February 2026

PMS AIF WORLD

brings to you

CRYSTAL GAZING 7.0

ALTERNATES SUMMIT & AWARDS 2026

Clarity in Uncertain Times

27th & 28th February 2026

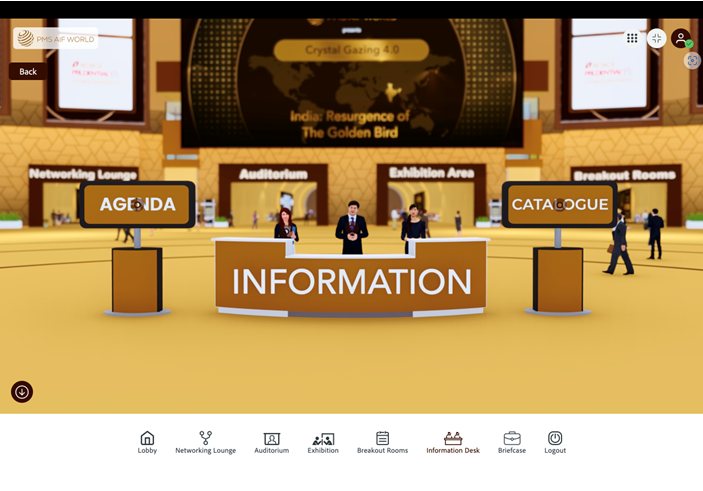

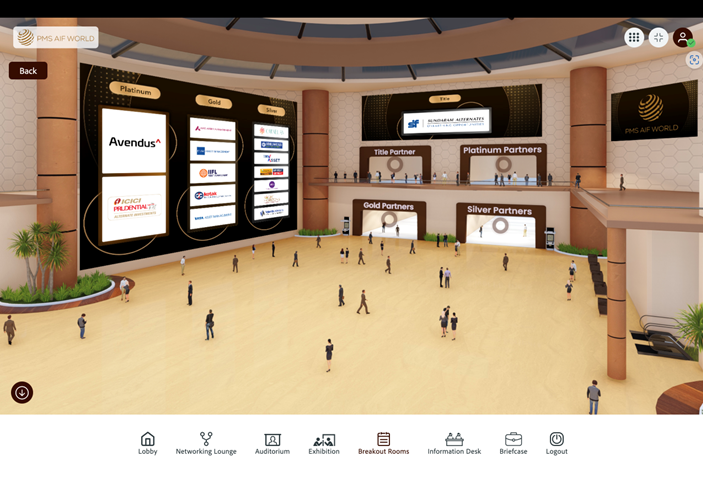

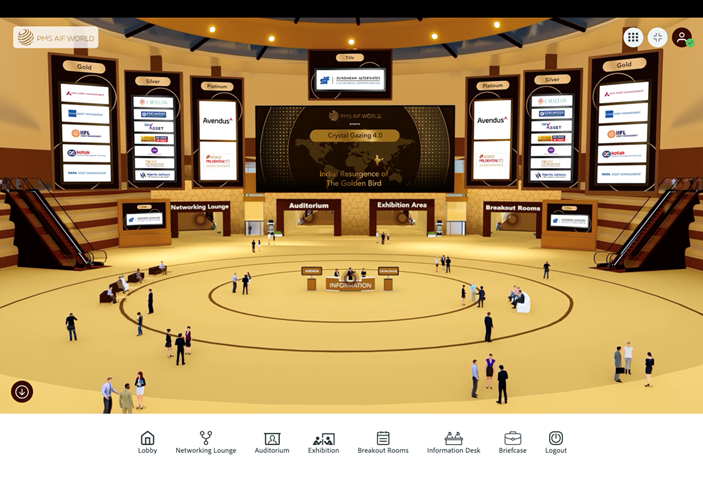

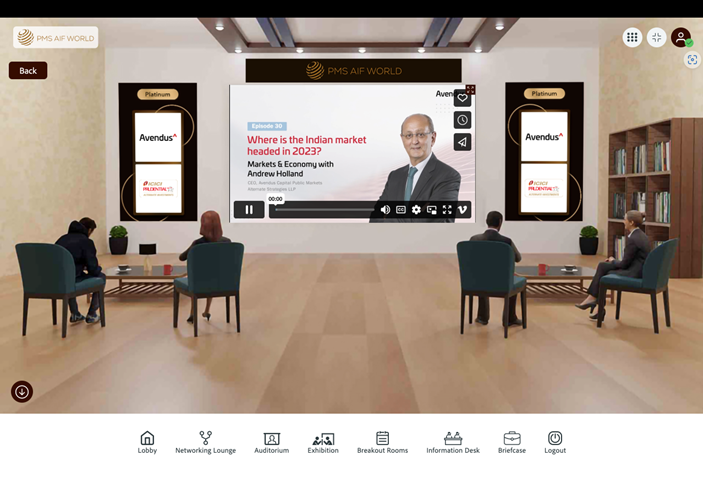

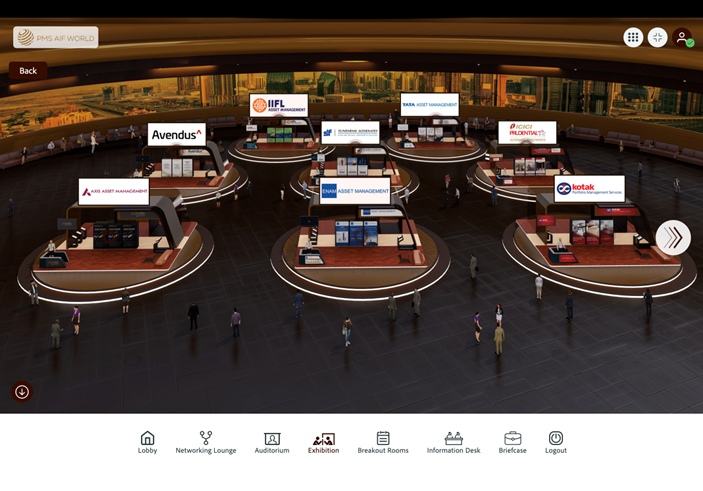

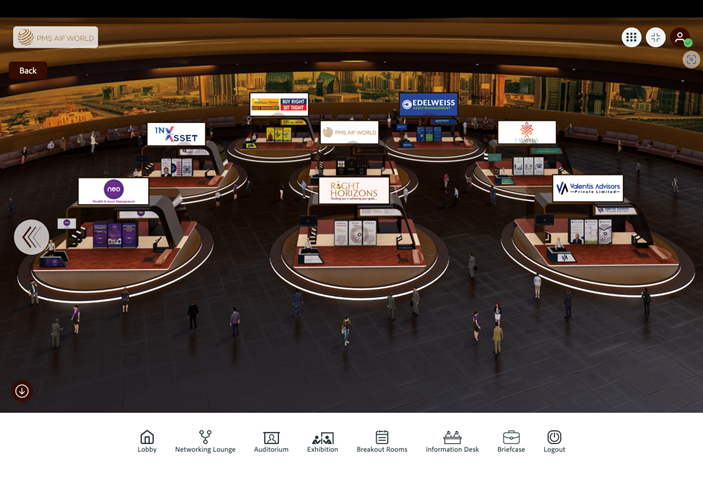

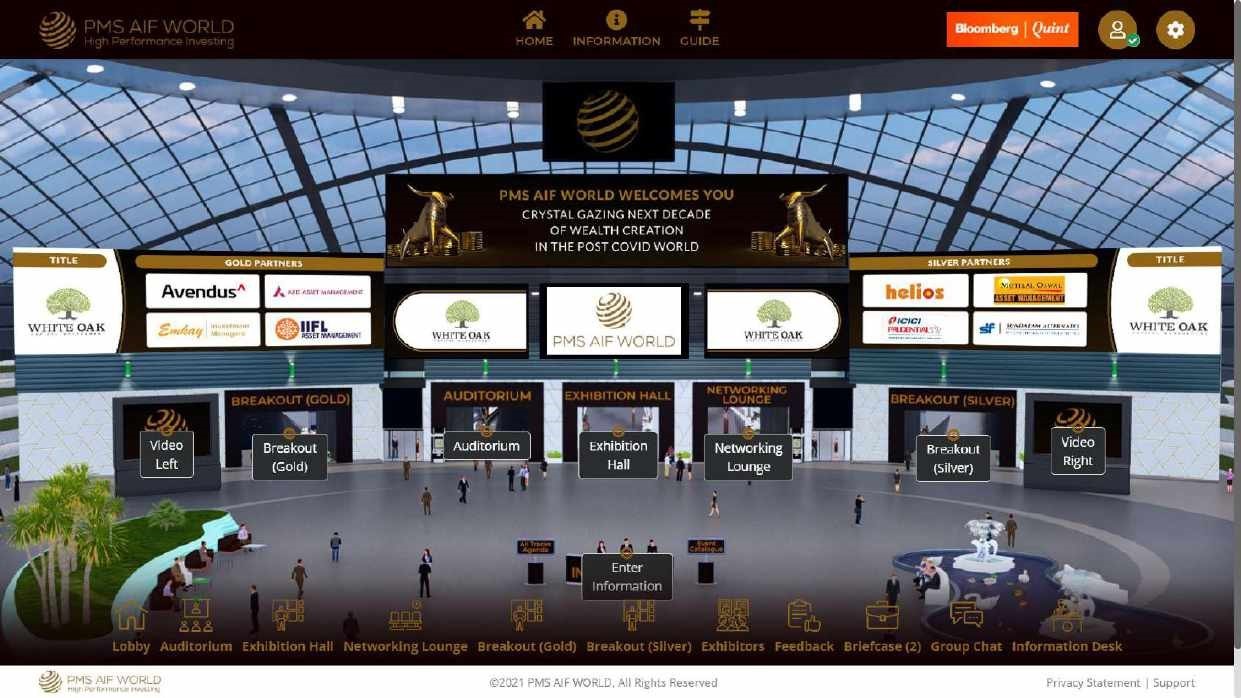

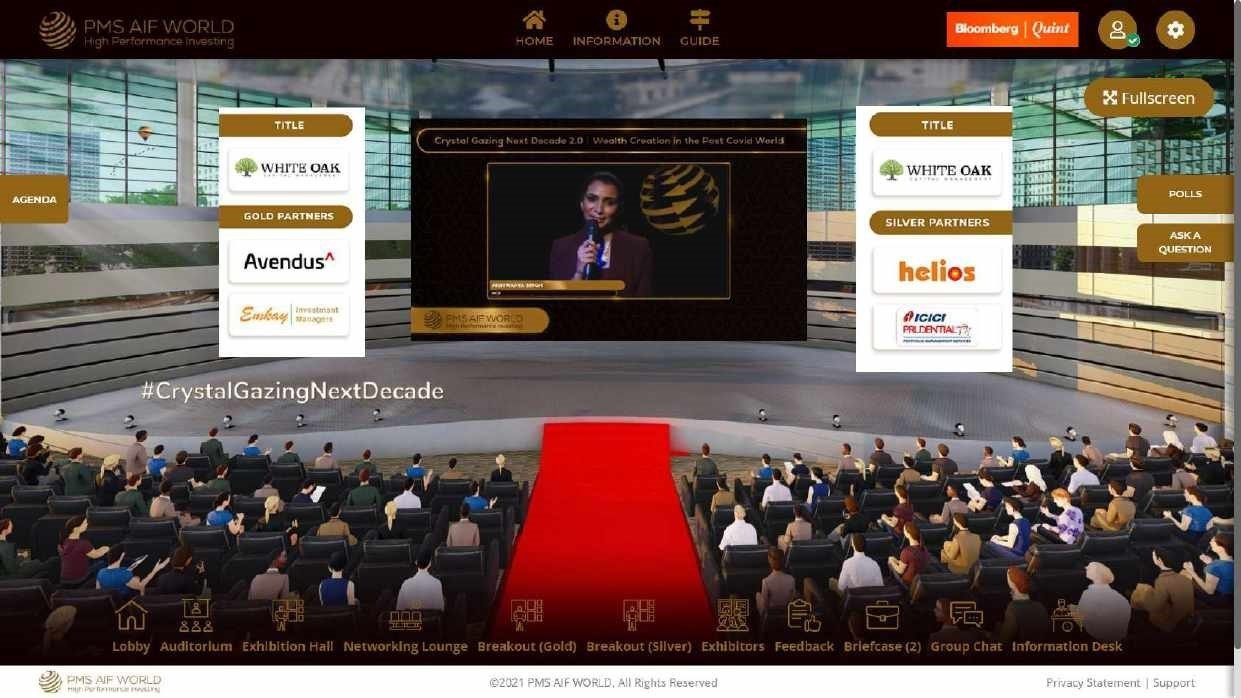

virtual global summit

About Crystal Gazing 7.0

Crystal Gazing 2026 is India’s leading investment summit, now in its 7th annual edition.

Designed for serious investors, fund managers, and market participants, the summit brings together 15 leading partners across two focused days, delivering 12+ hours of high-quality dialogue on long-term capital allocation.

Crystal Gazing also hosts India’s first and only objective, merit-based investment awards, presented in association with IIM Ahmedabad and known as the Smart Money Manager Awards.

The awards recognise fund managers based on transparent, data-driven evaluation frameworks, setting a higher standard for credibility and accountability in the investment ecosystem.

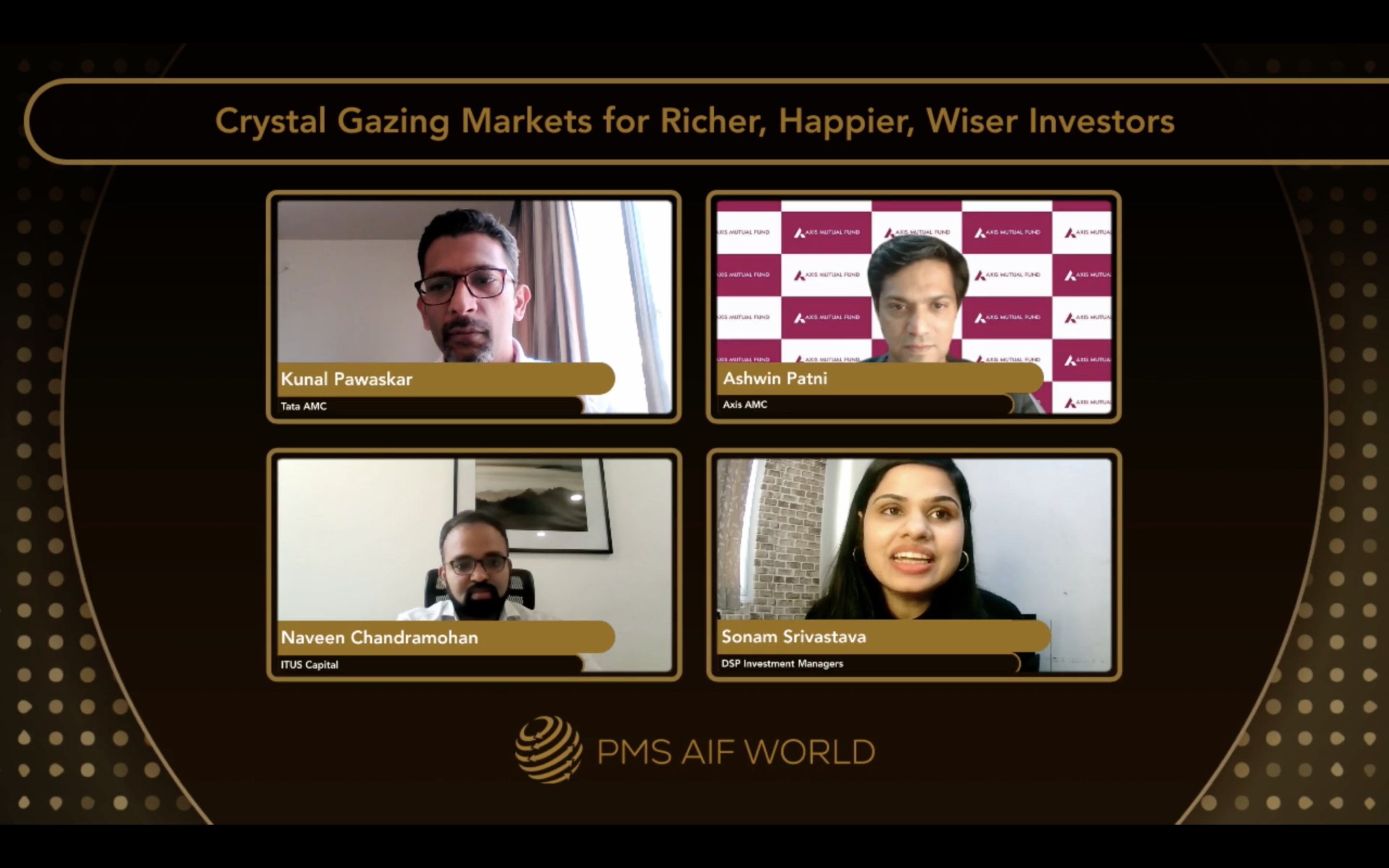

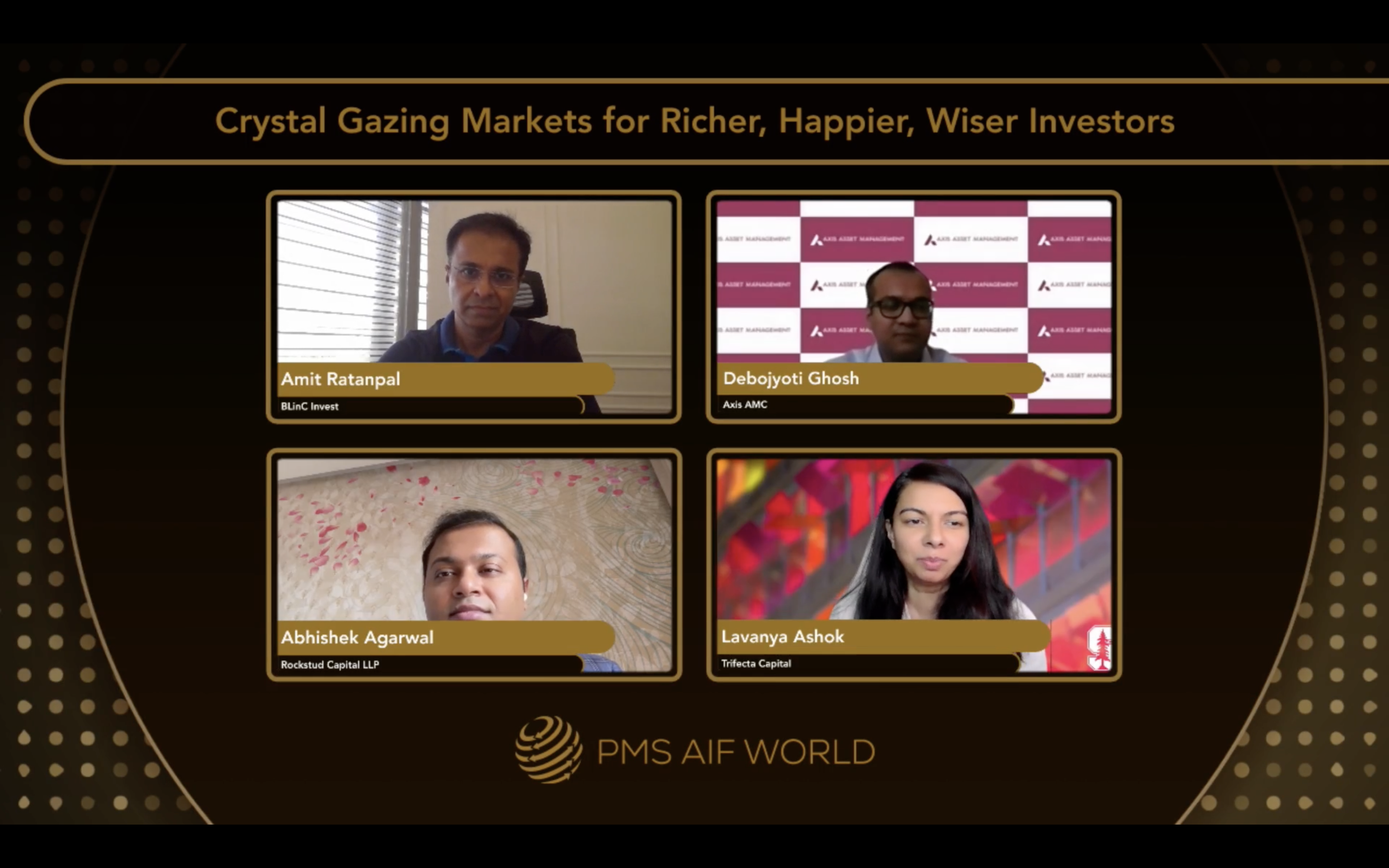

With 30+ experienced thought leaders and 12+ deeply insightful sessions, Crystal Gazing 2026 moves beyond market noise to examine where capital should be positioned for enduring compounding across cycles.

Discussions span public equities, long–short strategies, private equity, venture capital, private credit, and alternative assets, anchored in long-term, first-principles thinking.

This is not a prediction forum.

It is a merit-based platform that recognises investment discipline, intellectual honesty, and consistent performance, while enabling investors to step back from short-term volatility and focus on decisions that matter over the next decade.

Esteemed Speakers

Esteemed Moderators

Event Schedule

CRYSTAL GAZING 7.0: Clarity in Uncertain Times

Day 1 | 27th Feb 2026

Emcee

Ashwarya Singh

Decoding Market Signals: Noise, Narratives & What’s Next

Chockalingam Narayanan

Beyond Indian Equities: Where Can Investors Find Equity-Like Returns

Vishal Gupta | Ketul Sakhpara | Anil Rego Moderator: Mohit Bhagat

Superior equity investing structures designed to deliver high alpha with low beta

Andrew Holland | Harsh Agarwal | Vaibhav Sanghavi | Suraj Nanda Moderator: Bhautik Ambani

The Women’s Lens on India, Global Markets & Capital Allocation in 2026

Sonam Srivastava | Devina Mehra | Aparna Shanker Moderator: Shashi Singh

Thought Leader Lens to Invest in Indian Equities with Conviction in 2026

Sunil Singhania | Samit Vartak | Vikas Khemani | Pankaj Murarka Moderator: Kamal Manocha

Budget 2026 and Global Trade Deals: India’s Next Growth Triggers

Sanjaya Satpathy | Praveen Kumar | Manoj Bahety Moderator: Ritika Farma

From Seed to Scale to Exit: How Patient Capital Actually Creates Maximum Wealth

MR. P R Srinivasan | Anil Joshi | Rehan Yar Khan Moderator: Lavanya Ashok

Vote of Thanks and Context for the next day

Team PMS AIF WORLD

Day 2 | 28th Feb 2026

Welcome

Ashwarya Singh

Value Investing: Spotting Enduring Businesses Before, During & After Listing

Neil Bahal | Vineet Arora | Nishad Khanolkar | Abhishek Jaiswal Moderator: Kamal Manocha

How Reliable Is Growth Investing in Times of Uncertainty

Sandeep Daga | Prashant Khemka | Arun Subrahmanyam Moderator: N Mahalakshmi

Uncovering 10x to 100x with domestic deep tech investing across space, climate, health, defence and more

Bhaskar Majumdar

Private Credit Funds: The New-Age Alternative to Traditional Fixed Income Allocations

Rohit Popli | Piyush Chande | Rahul Chowdhury Moderator: Lakshmi Iyer

Different Roads, Same Destination: The Pursuit of Alpha

Amit Jeswani | Pawan Bharaddia | Radha Raman Agarwal Moderator: N Mahalakshmi

Awards

IIM A Team

Thank you

Team PMS AIF WORLD

Smart Money Manager Awards 2026

Recognising Consistent Excellence With IIM Ahmedabad

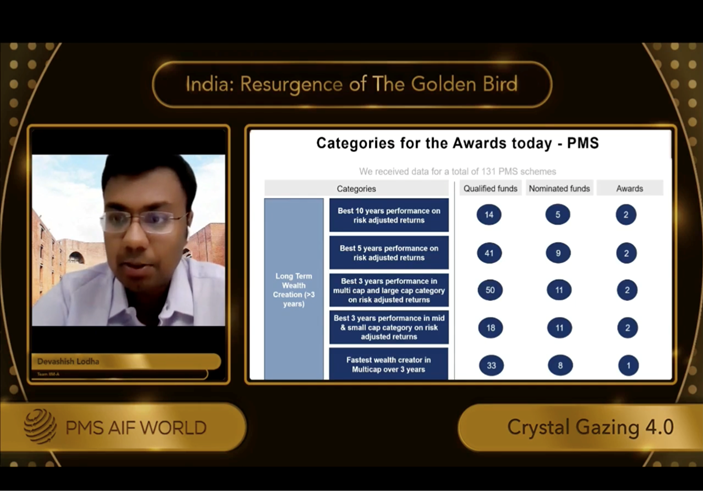

The awards follow a robust evaluation framework assessing performance across 10 categories over horizons of 1, 2, 3, 5, and 10 years.

20

AWARD WINNERS

Robust & Transparent

ACADEMIC PARTNER

Indian Institute of Management

Ahmedabad

Six Imp Questions that will be answered

Q1

What does the rise in gold and metals indicate about global risk and capital flows?

Q2

Is the AI boom in US equities sustainable or approaching a valuation bubble?

Q3

Why have Indian equities underperformed, and what lies ahead?

Q4

Where does the best risk-adjusted opportunity lie between Indian and global equities?

Q5

Which sectors could drive the next phase of growth in earnings and bull run?

Q6

What is the 2026 outlook for Indian equities and portfolio strategy?

Why Choose PMS AIF WORLD

Our Philosophy: Data-Backed, Diligence-Driven

We go far beyond surface-level performance numbers. Every Portfolio Management Service (PMS) and Alternative Investment Fund (AIF) we shortlist undergoes a deep-dive evaluation based on the 5Ps Framework:

At the heart of our approach lies QRC — our proprietary, risk-adjusted model that quantifies Quality, Risk, and Consistency through a comprehensive 9-factor framework. This model goes beyond surface-level returns, blending statistical rigor with real-world investing insight. By evaluating key metrics such as Sharpe Ratio, Information Ratio, and upside/downside capture — among several others — we measure not just how much a strategy delivers, but how efficiently and consistently it does so. The result is a truer picture of performance durability, separating skill from mere market noise.

UHNIs & NRIs Served

AUM (in Cr)

PMSs & AIFs listed

Countries

Cities

Core Themes & Discussions

CRYSTAL GAZING 7.0 : Clarity in Uncertain Times

27th & 28th February 2026