SMSF FAQs – Know Before You Invest

How can I invest in Indian equities with my Super?

Set up an SMSF, which allows you to directly invest in Indian markets.

Is this compliant with ATO regulations?

Yes. SMSFs can invest in overseas equities as long as the investments are held in the name of the trustees listed in SMSF. Refer to screenshot from ATO’s website

Any there any extra taxes for investing in India?

No. India has 12.5% LTCG tax. Due to DTAA between India & Australia, no double taxation applies. For more information, please consult an accountant for more details.

Is it safe to invest in Indian equities?

India is the 5th largest economy with well-regulated markets. Volatility exists as in any other markets, but growth potential is high and there is track record of exceptional returns over 40 years.

What kind of transparency do PMS/AIFs offer?

Full visibility via quarterly, monthly and yearly reports, statements and real-time performance tracking along with details of holdings in your account. Reach out to us for more information and access to PMS and AIF reports.

Can I repatriate the super funds back to Australia?

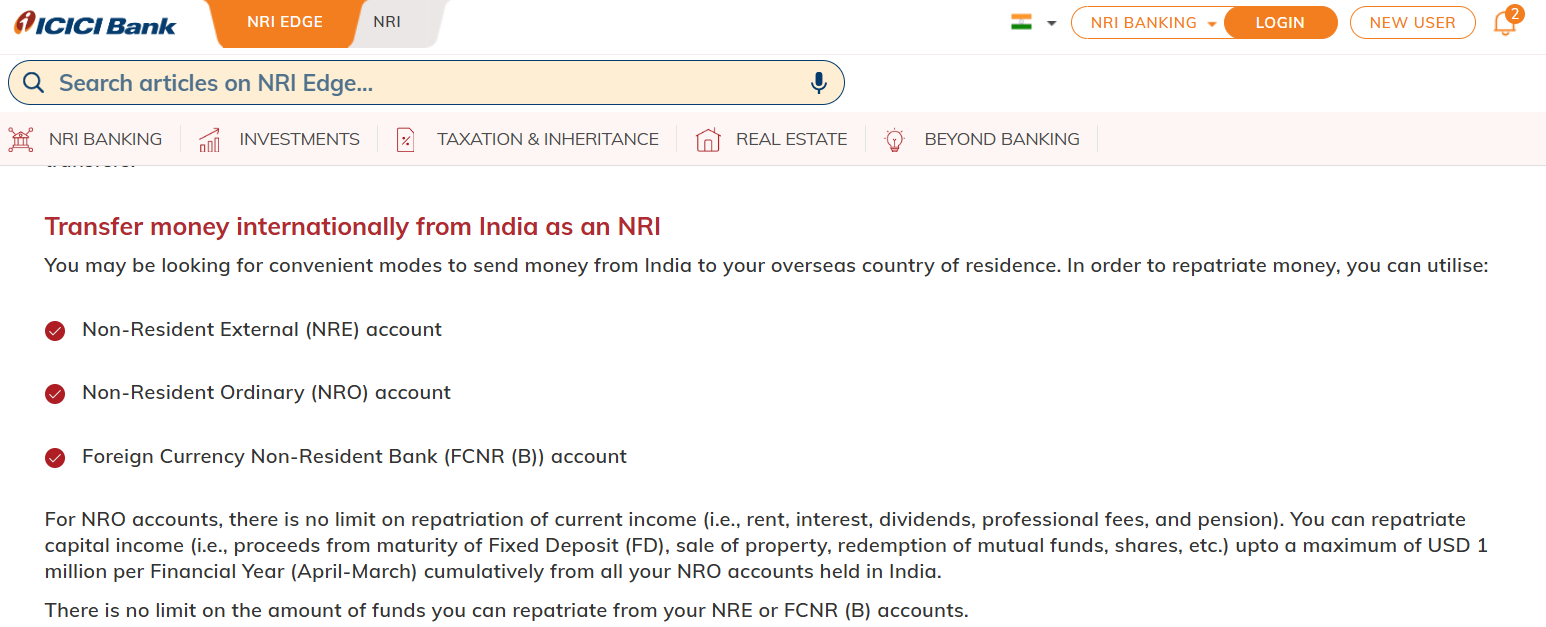

Yes. NRIs have no restrictions of transferring money back to Australia. Refer to the screenshot below from the website of one of the largest banks in India. Check with your Bank’s relationship manager for more information.

As it shows here that there’s no limit on transferring money from an NRE account from India to Australia when you want to start transferring the money. Please check with your bank’s relationship manager for more details.

What's the minimum balance required for SMSF set up?

SMSFs can be set up with even $90,000. We have clients who have set up SMSF with about 90,000$ and have invested in a PMS.

Can I link life insurance to SMSF?

Yes. Speak to your insurance provider.

I don’t have a PAN card. Can I still invest?

Yes. If you’re of Indian origin, we can help you get a PAN card, even if you were born in Australia.

Can my spouse and I merge our Super?

Yes. it is possible to merge your spouse’s super for SMSF.

What are the ongoing expenses for maintaining an SMSF?

Other than the cost of setting up SMSF, there’s yearly audit fees. You can pay for this from the subsequent contributions which will be credited to your super account and hence there are no expenses which are out of pocket, other than the set-up fees.

Can SMSF be invested in GIFT City?

Can I invest personal (non-super) funds?

Absolutely. This is separate from SMSF and if you are after financial freedom, it is a wonderful option. Many start with Super, then add personal funds after seeing results.

Ready to Start? Speak to Our Sydney-Based Expert

Prabhu Suriyanarayanan

SMSF Specialist for Indian Equities

📱 Mobile/WhatsApp: 0489 215 550

📧 Email: prabhu@pmsaifworld.com

🎥 Watch Our Explainer Video