Date & Time: June 10, 2022 @ 3:30 PM – 4:30 PM IST

Speaker: Mr. Naveen Chandramohan, Founder, ITUS Capital

Moderator: Kamal Manocha, Founder & CEO, PMS AIF WORLD

The Normalising World- Death of Growth & Resurrection of Value?

Mr. Kamal Manocha, Founder and CEO of PMS AIF World held an engaging webinar in conversation with Mr. Naveen Chandramohan of ITUS Capital and discussed the nuances around growth and value investing, in current times when fear has taken over the investors.

About PMS AIF World

PMS AIF World is a knowledge-driven, New Age Investment Services Company, providing analytics-backed quality investing service with an endeavor and promise of wealth creation and prosperity. We offer the finest PMS & AIF selection process after analyzing the products across 5 Ps – People, Philosophy, Performance, Portfolio, and Price, with an endeavor to ascertain the Quality, Risk, and Consistency (QRC) attributes that covers 9 ratios. We do such a detailed portfolio analysis before offering the same to investors.

We are a responsible and long-term investment service provider in the space of Alternates.

Invest through us in the best quality products and make informed investment decisions.

Speaker Profile

Mr. Naveen Chandramohan is the Founder and Principal Fund Manager at ITUS Capital. Mr. Chandramohan has had illustrious career spanning 15 years in the financial services sector having worked across fund management, fund raising and fundamental research. He began his Financial Services career with Lehman Brothers in Tokyo, as a Senior Analyst in the Capital Markets Trading desk.

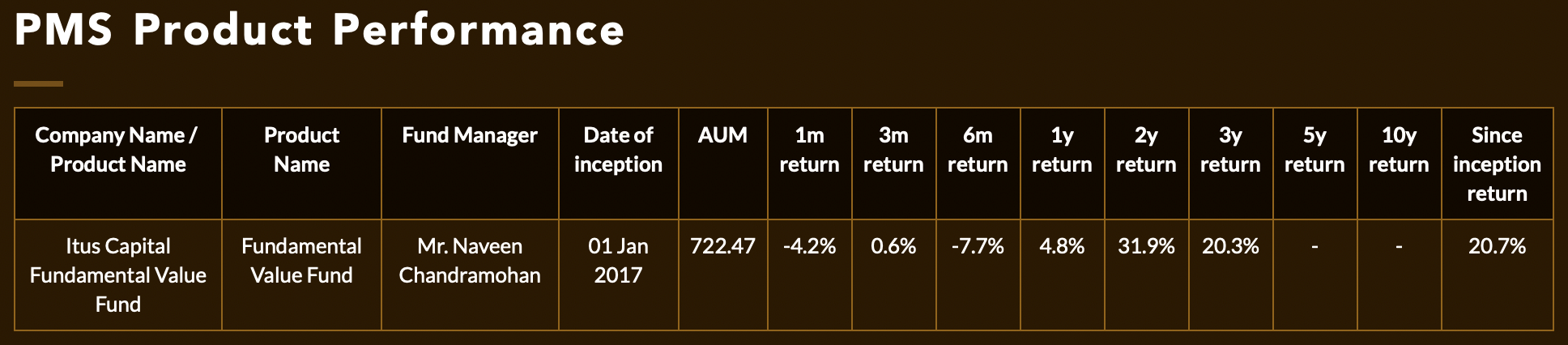

He is responsible for running the fund and takes all the portfolio and risk decisions at ITUS Capital, which currently offers one PMS- ITUS Capital Fundamental Value Fund.

Valuations play a key role when making investment decisions. A wise, knowledgeable fund manager or an investor will not invest in a stock just because it is a “good company.” Over and above the fact that the business is good, one should also look at the true value of the business.

Growth matters, but growth at reasonable prices is the right approach to investing.

While calculations of a fair price might be subjective, it is important to understand that the fall in prices necessarily does not make it attractive; one has to also look at the valuations of the stock before making an investment decision, i.e., one needs to look at all the aspects before deciding to own a business.

Equity markets teach us old lessons in new ways as it continues to be evolving in nature. The terminology of growth and value have been lost in lengthy discussions that a sense of fear has crept among investors. There are quality businesses that have fallen due to obnoxious valuations in the recent past and have dampened the spirits to a certain extent.

On the other hand, few mediocre businesses have growth potential that has to be unlocked combined with a decent valuation when compared to the market. Hence, it is ideal to talk about whether to enter consistent businesses or enter new-age businesses that have a lot of potential.

The confirmation bias around our decision-making ability has led us to accept businesses at any valuation in the last 2 years. The question arises here is that is growth dead and what value is yet to be unlocked. The words growth and value are used interchangeably as in 2011 Google was a value stock but the recent upturn over the last few years has led it to become a growth stock.

The stock price for the same went 5x in the last 8 years which came from the EPS rising 4x and re-rating of the stock. It was a consistent business and cash flow growth that led to returns rather than its re-rating in the market. The SAAS businesses have resurrected themselves in the last 4 years as growth normalised in the same period where valuations were over the top.

The situation has changed from a liquidity perspective and valuations are mean reverting for all businesses. At ITUS, there are three lenses through which a business is looked upon, namely, the growth of the market share of the business, are the cash flows growing for the business and whether it is reasonably priced or not.

In Indian context, value can be defined as growth at a reasonable price as B2B companies have shown margin expansion even during this quarter. The NIFTY 50 top 20 index has a weightage of 42% towards the IT sector and completely avoiding the financial sector.

The weights for the financial sector in the ITUS Fundamental Value PMS have come down significantly as there continues to be value in it which is to be unlocked in the future. The business model at ITUS is such that they maintain a single fund and it will remain underweight in the financial sector.

ITUS’ Fundamental Value Fund PMS mix looks like the following:

As it is evident, the portfolio comprises of both old age & new age businesses.

Investors look to average down on such stocks, or first timers rejoice at the fact that they are entering something which is valuable. The competitive intensity in the landscape and the management’s ability to reinvest capital in the business are crucial points to note when entering such stocks.

It was exciting to know that there are two ways in which investors can make 100x returns:

- Enter a stock when valuations are depressed

- Enter a stock when it is equally discomforting

The benefit of time needs to be given to businesses as the only other way to make 100x returns is by remaining invested for 20 years.

There are several businesses that will help you generate returns, but investing is all about changes and evolution in your decision-making process, says Mr. Naveen Chandramohan.

The question is not how you see it but how you react when the narrative changes. There are only 3-5 chemical businesses with stellar returns as most of them continue to bite the dust. The best business does not mean that the investors stand to gain via the best returns. For instance, Microsoft is an amazing business but barely gave returns in the last 11 years.

The capital and liquidity situation in India is quite different when compared to 20 years in the past. The buy and hold strategy would pay off easily during that time given the scarcity of capital and quality businesses. We are in a normalization driven world where supply and demand are poised to meet over the next 2-3 quarters. It is then that India’s growth story will be unlocked and any volatility during that time will be used to deploy capital.

It is aptly put by John Templeton that the four most scary words in the equity markets are ‘It’s different this time’. It is true that markets oscillate between fear and greed, and it is the former that has slowly crept in the market today. The supply chain disruption in India is one of the positives that one can take forward in the post-pandemic world.

Investors should look at returns made in the following year rather than saying how much will I make by the end of this year. Periods of discomfort make the investing process more lucrative while periods of ease will see muted one-year forward returns. Mr. Naveen Chandramohan strongly believes that we are in the 2nd stage of correction with one more right around the corner to take place.

The next few quarters are going to be volatile and ITUS Capital, as a fund house will deploy capital soon.

If you understand the businesses that you own, it will not be difficult for you to own it during a 20% drawdown.

Even after the correction, there are good quality businesses available at the right valuations where due importance needs to be given to returns rather than risk. Furthermore, investors need to realize that liquidity is turning out to be scarce while growth and valuations continue to work in collaboration. Lastly, it is advised that investors be patient and not aggressive during such difficult times where a staggered way of investing will reap benefits for all.

RISK DISCLAIMER: Investments are subject to market-related risks. This write up is meant for general information purposes and not to be construed as any recommendation or advice. The investor must make their own analysis and decision depending upon risk appetite. Only those investors who have an aptitude and attitude to risk should consider the space of Alternates (PMS & AIFs). Past Performance may or may not be sustained in the future and should not be used as a basis for comparison with other investments. Please read the disclosure documents carefully before investing. PMS & AIF products are market-linked and do not offer any guaranteed/assured returns. These are riskier investments, with a risk to principal amount as well. Thus, investors must make informed decisions. It is necessary to deep dive not only into the performance, but also into people, philosophy, portfolio, and price, before investing. We, at PMS AIF World do such a detailed 5 P analysis.

Wish to make INFORMED INVESTMENTS for Long Term WEALTH CREATION